In the dynamic world of decentralized finance, mitigating financial risks has always been a challenge. Enter Fibonacci Finance, a platform dedicated to providing tailor-made risk management solutions for DeFi projects, NFT ventures, and DAOs.

TLDR

- Fibonacci Finance offers specialized risk management solutions for DeFi projects, NFT ventures, and DAOs, featuring APIs, risk dashboards, and boutique consultations.

- Fibonacci’s suite of APIs allows users to analyze financial risks associated with Radix assets, aiming to fill the gap in affordable and effective risk management tools in the DeFi sector.

- Co-founders Shimon and Samiar aim to make DeFi a robust alternative to traditional finance, with plans for major chain expansion and pioneering financial risk models in their roadmap.

What is Fibonacci Finance

Fibonacci Finance is a comprehensive platform aimed at addressing the financial risk management needs within the DeFi ecosystems. Catering to DeFi projects, NFT projects, and DAOs with the need for managing on-chain liquidity, Fibonacci Finance extends its expertise through a slew of offerings, including APIs, dedicated risk dashboards, and boutique consultations.

The platform is adept at supporting clients at varying stages of their lifecycle, making it a valuable ally for projects yet to embark on financial risk analysis of their native assets or platform.

The distinctive APIs provided by Fibonacci Finance permit users to scrutinize the financial risks associated with popular Radix assets directly from on-chain data, marking a pioneering feat for Radix and opening a window of opportunity for its developers.

The precarious nature of financial risks in decentralized finance has been a persistent concern, with financial exploits denting the sector by billions of dollars in recent years alone. Unlike smart contract attacks that hinge on code discrepancies, financial exploits prey on gameable lapses in protocol logic, pool composition, or oracle pricing mechanisms.

The conventional recourse of deploying dedicated risk teams or seeking bespoke solutions is often exorbitantly priced and out of reach for nascent DeFi protocols or Scale-Ups.

This is where Fibonacci Finance carves a niche, offering flexible risk-focused APIs that empower all DeFi players with the crucial insights necessary for informed risk-mitigation decision-making.

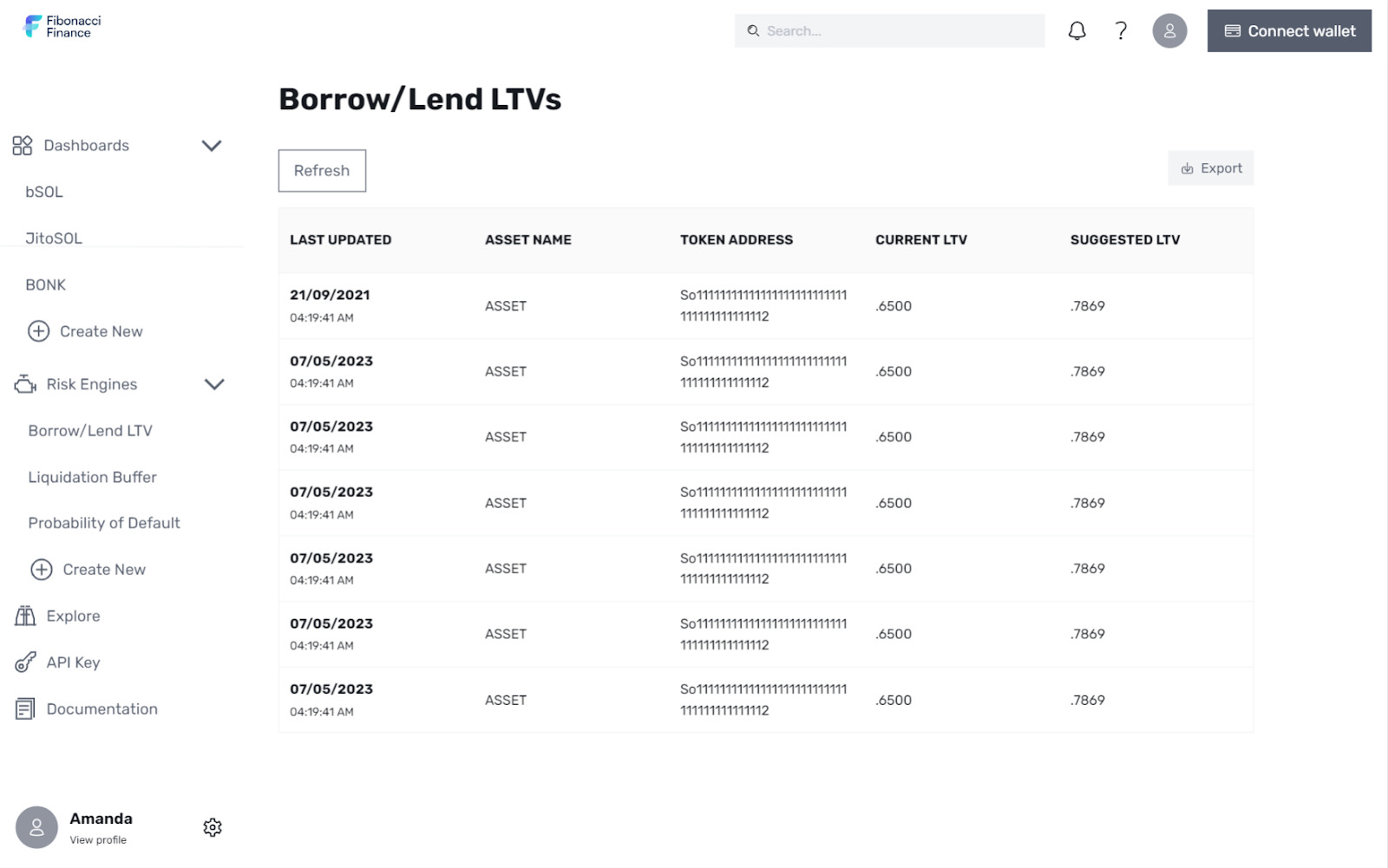

These APIs fuel a range of powerful proprietary risk tooling, embodying an approach that not only delivers superior risk insights and visualizations but does so at a fraction of the cost and time compared to competitors. Through real-time data streaming, comprehensive risk reports, and customizable dashboards, Fibonacci Finance is revolutionizing how stakeholders in the DeFi space approach and manage financial risks.

Example Use Case: DeFi Innovative

Consider a hypothetical scenario involving a DeFi startup called ‘DeFi Innovate.’ This startup has recently launched its token and is gaining traction in the market. However, they lack the in-house expertise and tools to effectively manage the financial risks inherent in their protocol, especially concerning liquidity management and financial exploits that prey on protocol logic flaws.

As they scale up, the leaders at DeFi Innovate decide to utilize Fibonacci Finance to bolster their risk management capabilities. They leverage Fibonacci’s APIs and real-time risk data streaming to develop an in-house risk engine.

This allows them to monitor and mitigate potential financial risks continually, ensuring the security and stability of their protocol as it grows. Through Fibonacci’s risk dashboards, they also gain invaluable insights into their on-chain liquidity, enabling them to make informed decisions to optimize it further. This collaboration significantly elevates DeFi Innovate’s risk management posture, safeguarding their protocol against financial exploits and ensuring a smoother scaling process.

The Fibonacci Borrow Loan-to-Value (LTV) Ratio

The Inception and Journey of Fibonacci Finance

Founding Vision

Shimon and Samiar, with backgrounds in International Political Economy and International Business & Finance, converged in the Netherlands six years ago. Their shared ambition: making DeFi a robust alternative to traditional finance. Samiar and Shimon were working together at an early-stage Venture Capital Firm when DeFi exploded in 2021. They realized that this was the moment for their interests and experiences to converge, and they developed a collateralized debt position (CDP) on Solana. After winning first prize at Jump Crypto’s xHack in November of 2022, the Fibonacci team realized that the risk engine of their CDP platform was applicable to all chains and that financial risk is something that needed to be mitigated in order for DeFi to go mainstream. With that, they began developing Fibonacci full-time.

Embarking on DeFi

Post-2021’s DeFi surge, they transitioned into the sector full-time. Their prior experience with a DeFi platform equipped them with insights into the industry’s inherent volatility and financial risks. The prohibitive costs of conventional risk management solutions led to the inception of Fibonacci Finance. Their victory at xHack, Chicago, further propelled the project, aimed at democratizing top-notch risk management across the DeFi landscape.

Building on Radix

Choosing Radix Over Others

Opting for Radix, with its native-layer composability, security, and DeFi-centric approach, over networks like Ethereum was driven by the ambition to align with transformative DeFi projects drawn to Radix’s distinctive features.

Radix’s tech stack not only augments Fibonacci’s functionalities but also promises future contributions to Radix’s Blueprint Catalog, amplifying composability with other Radix projects. This strategic alignment with Radix is a step towards deeper integration and collaborative growth within the DeFi ecosystem.

Roadmap Ahead

Ambitiously aiming to support every burgeoning DeFi ecosystem, their roadmap includes major chain expansion, successful fundraising, and pioneering financial risk models, striving to establish Fibonacci as an indispensable risk management tool in the DeFi arena.

“As more and more liquidity inevitably finds its way into the Radix ecosystem, Fibonacci will be there to support the most innovative DeFi, NFT, and token projects that emerge. We look forward to continued collaboration with the growing and vibrant Radix ecosystem!”

For more information on the project, head to the website, and follow the project’s official Twitter account.

The Fibonacci Finance team provided all information about Fibonacci Finance and has not been verified by Radix Publishing, RDX Works, or their associated companies.