This content is for educational purposes only and does not constitute financial advice. Always do your own research before making any lending or borrowing decisions.

The Radix Rewards Campaign is live, and lending on WEFT Finance is a powerful way to earn Activity Points while putting your assets to work. WEFT is an innovative lending and borrowing platform on Radix that lets you earn competitive interest rates while contributing to the ecosystem’s growth. This tutorial will walk you through exactly how to lend on WEFT to earn your share of 1b $XRD.

What You’ll Need

Before you start lending, make sure you have:

- Radix Wallet downloaded and set up (get it here)

- XRD tokens for transaction fees

- Supported assets to lend – Bridge via Astrolescent.

- Enrolled accounts in the Radix Rewards program

- Minimum $50 worth of XRD/LSU holdings across all linked accounts

Supported Assets That Earn Points

When lending on WEFT Finance, you’ll earn Activity Points (AP) specifically for lending supported assets.

Important: Always make sure to visit the Rewards dashboard to see what assets, pairs, and pools earn you points: https://incentives.radixdlt.com/dashboard/earn

Step-by-Step Lending Guide

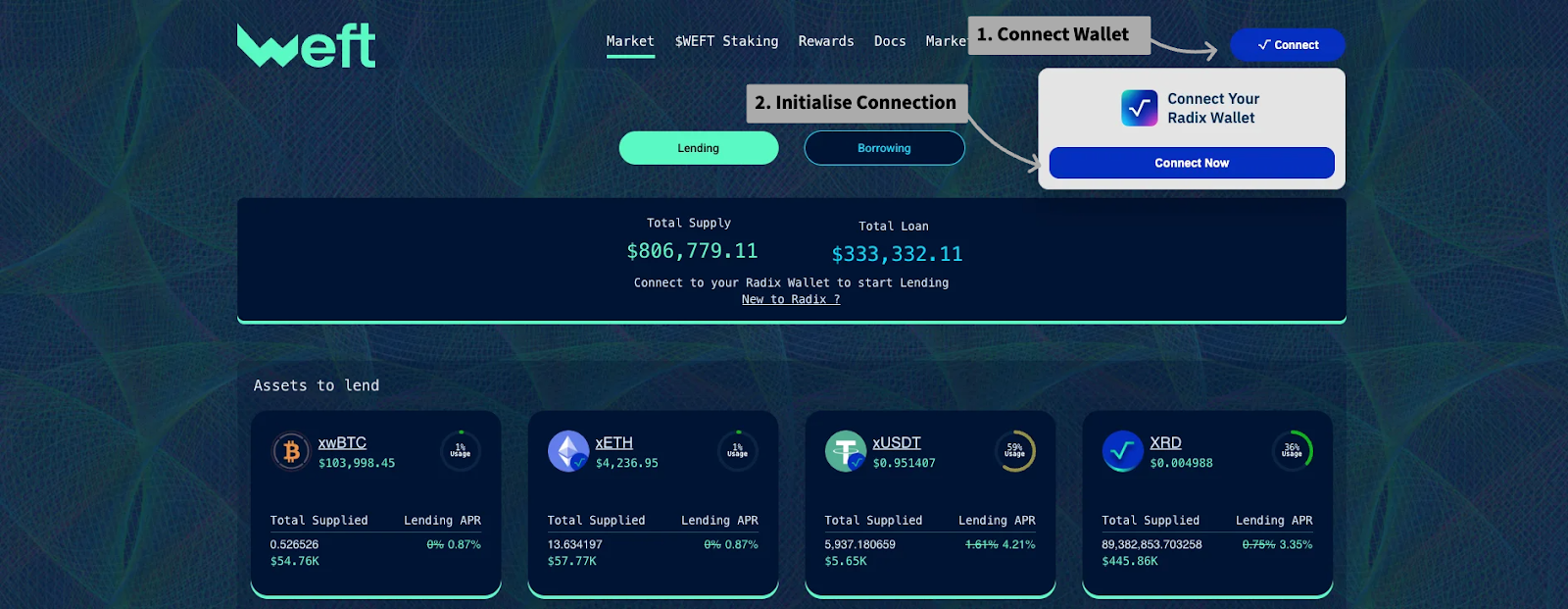

Step 1: Access WEFT Finance

- Navigate to https://app.weft.finance/market

- Click ‘Connect Wallet’ in the top right corner

- Approve the connection in your Radix Wallet mobile app

Step 2: Navigate to the Lending Section

- Once connected, you’ll see the WEFT dashboard

- Look for the ‘Lending’ section on the main interface

- You’ll see a list of available lending pools with their current APR rates

Step 3: Choose Your Asset to Lend

- Review the available lending pools for supported assets

- Check the current lending APR for each asset

- Consider the utilization rate and total supplied amount

- Click “Supply” on the asset you want to lend (e.g., hUSDC, XRD)

Step 4: Supply Your Assets

- Enter the amount you want to lend in the “type amount” field

- Check that you have enough balance in your wallet

- You can see your available balance in the “Max amount” field

- Click ‘Confirm”

Step 5: Confirm the Transaction

- Review the transaction details in your Radix Wallet

- Verify the amount and asset type

- Approve the transaction in your wallet

- Wait for the transaction to confirm

Step 6: Receive Your w2-Assets (Deposit Units)

- After lending, you’ll receive w2-Assets (e.g., w2-hUSDC, w2-XRD) – interest-bearing tokens that represent your deposit

- These tokens automatically accrue interest over time

- The amount of w2-tokens matches your deposit (e.g., lend 100 hUSDC → receive 100 w2-hUSDC)

- You can view your w2-Assets in your Radix Wallet

- These tokens can be transferred or used in other DeFi protocols

Understanding w2-Assets: Your Interest-Bearing Tokens

W2-Assets (also called Weft Deposit Units) are fungible tokens that represent your lending position in WEFT Finance. Here’s what makes them special:

- Interest-Bearing: They automatically accumulate interest over time based on the pool’s APY

- Transferable: You can send your w2-tokens to another wallet, transferring the lending position

- Composable: Similar to Radix Pool Units, they can be used in secondary markets

- Redeemable: Exchange them back for your original assets plus earned interest at any time

- Transparent: The exchange rate between w2-Assets and underlying assets increases over time as interest accrues

Pro Lending Tips for Maximum Points

Diversify Your Lending: Spread your assets across multiple supported tokens to potentially earn points in different categories.

Monitor APY Rates: Interest rates fluctuate based on supply and demand. Check regularly for the best rates.

Consider Long-term Positions: Points are calculated weekly based on time-weighted averages, so consistent lending may be more beneficial than frequent withdrawals.

How Points Are Earned from Lending

When you lend on WEFT Finance, you earn Activity Points based on the USD value of your supplied assets over time:

Weekly Conversion Process:

- During the week: Provide liquidity → Earn Activity Points (AP)

- End of the week: AP converts to Season Points (SP) based on your ranking vs others. Your SP is then multiplied by your XRD/LSU holding bonus (0.5x to 3x)

The more USD value you supply and the longer you maintain your position, the more Activity Points you’ll earn.

For a detailed explanation of the point system, check out the complete guide: How You Earn Points in the Radix Incentives Campaign

Understanding WEFT’s Interest Rate Model

WEFT uses a dynamic interest rate model based on pool utilization:

Normal Demand (0-70% utilization): Lower interest rates to encourage borrowing and maintain active liquidity.

High Demand (70-90% utilization): Interest rates increase as capital becomes more scarce, rewarding lenders with higher APY.

Max Utilization (90-100% utilization): Sharp interest rate increases to incentivize repayments and new deposits, maximizing lender returns.

This model ensures you earn competitive rates that automatically adjust based on market demand for your supplied assets.

Important Reminders

- Enroll First: Make sure you’ve enrolled in the Radix Rewards program and linked your lending accounts

- Minimum Holdings: You need at least $50 worth of XRD/LSU across all linked accounts to start earning points

- Supported Assets Only: Only assets listed on the rewards platform earn incentive points on WEFT

- Weekly Rankings: Points are calculated weekly, so consistent lending activity matters

- Smart Contract Risk: As with all DeFi protocols, there are inherent risks. Only lend what you can afford to lose

Withdrawing Your Funds

When you want to withdraw:

- Go to the WEFT Finance lending interface

- Navigate to your supplied assets and click “Withdraw”

- Enter the amount of w2-tokens you want to redeem

- Click ‘Withdraw’ or ‘Redeem’

- Confirm the transaction in your wallet

- Your w2-tokens will be exchanged for the underlying assets plus earned interest

Note: The exchange rate between w2-tokens and underlying assets increases over time as interest accrues, so 100 w2-hUSDC will be worth more than 100 hUSDC when you withdraw.

Next Steps

Now that you know how to lend on WEFT Finance for incentive points, consider exploring:

- Borrowing against your collateral on WEFT

- Trading on Ociswap or CaviarNine

- Providing liquidity to DEX pools for additional point categories

- Lending on Root Finance for diversification

Ready to start earning points through lending? Head over to WEFT Finance and begin supplying your assets to the supported pools. Remember to manage your risk appropriately and only lend within your comfort zone.

Have questions about WEFT Finance? Join their Telegram community or follow them on X.